20

experience with accounting rules and practices; and

the desire to balance the considerable benefit of continuity with the periodic addition of the fresh perspective provided by new members.

Each Company’sThe Nominating and Corporate Governance Committee’s goal is to assemble a Board that brings it a variety of perspectives and skills derived from high quality business and professional experience.

Other than the foregoing, there are no stated minimum criteria for director nominees, although each Company’sthe Nominating and Corporate Governance Committee may also consider such other factors as it may deem are in the Company’s best interests and those of its stockholders. Neither Company’sThe Nominating and Corporate Governance Committee assignsdoes not assign specific weights to particular criteria, and no particular criterion is necessarily applicable to all prospective nominees. EachThe Company believes that the backgrounds and qualifications of the directors, considered as a group, should provide a significant composite mix of experience, knowledge and abilities that will allow eachthe Board to fulfill its responsibilities. The Boards doOther than the requirements of applicable law or Nasdaq listing rules, the Board does not have a specific diversity policy, but considers diversity of race, religion, national origin, gender, sexual orientation, disability, cultural background and professional experiences in evaluating candidates for Board membership.

Each Company’sThe Nominating and Corporate Governance Committee identifies nominees by first evaluating the current members of the Board willing to continue in service. Current members of the Board with skills and experience that are relevant to the applicable business and who are willing to continue in service are considered forre-nomination, balancing the value of continuity of service by existing members of the Board with that of obtaining a new perspective. If any member of the Board does not wish to continue in service or if the Nominating and Corporate Governance Committee or the Board decides not tore-nominate a member forre-election or the Board decides to add a new director to the Board, the Nominating and Corporate Governance Committee would identify the desired skills and experience of a new nominee in light of the criteria above. Current members of each Company’sthe Nominating and Corporate Governance Committee and the Board would review and discuss, for nomination, the individuals meeting the criteria of the Nominating and Corporate Governance Committee. Research may also be performed to identify qualified individuals. The Nominating and Corporate Governance Committee of each Company has not, but may choose to, engage an independent consultant or other third party to identify or evaluate or assist in identifying potential nominees to such Company’sthe Board.

Co-Investment CommitteesCommittee

Each Company’sThe Co-Investment Committee is responsible for reviewing and approving certainco-investment transactions in accordance with the conditions of the exemptive order wethe Company received from the SEC. The charter of eachthe Company’sCo-Investment Committee is available in print to any stockholder who requests it.

OCSL

The current members of OCSL’sthe Co-Investment Committee are Messrs. Dutkiewicz, John B. Frank, Gamsin, Jacobson Ruben and Zimmerman and Mses. Caldwell and Gero, each of whom is not an interested person of OCSLthe Company as defined in the 1940 Act and is independent for purposes of the NASDAQNasdaq listing rules, with the exception of Mr. John B. Frank who is an interested person as defined in the 1940 Act. Mr. GamsinZimmerman currently serves as the ChairmanChair of the OCSLCo-Investment Committee.

The Risk and Conflicts Committee is responsible for assisting the Board in fulfilling its oversight responsibilities in connection with the Company’s management of its credit risk and consideration of conflicts of interest. The charter of the Risk and Conflicts Committee is available in print to any stockholder who requests itOCSI.

The current members of OCSI’sCo-Investmentthe Risk and Conflicts Committee are Messrs. Cohen, John B. Frank, Gamsin, Jacobson Ruben and Zimmerman and Mses. Caldwell and Gero, each of whom is not an interested person of OCSIthe Company as defined in the 1940 Act

and is independent for purposes of the NASDAQNasdaq listing rules, with the exception ofrules. Mr. John B. Frank who is an interested person as defined in the 1940 Act. Mr. GamsinZimmerman currently serves as the ChairmanChair of the OCSICo-InvestmentRisk and Conflicts Committee.

21

EachThe Company has adopted a joint Code of Business Conduct which applies to, among others, executive officers, including the principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions and all other officers, employees and directors of the Companies.Company. If eitherthe Company makes any substantive amendment to, or grants a waiver from, a provision of the Code of Business Conduct, suchthe Company will promptly disclose the nature of the amendment or waiver on its website at https://www.oaktreespecialtylending.comwww.oaktreespecialtylending.com.

The Company has adopted a Securities Trading Policy that, among other things, prohibits directors, officers and other employees from entering into a short sale transaction or https://www.oaktreestrategicincome.com, as applicable.transactions in puts, calls or other derivative securities, on an exchange or in any other organized market, with respect to the Company’s securities or use any other derivative transaction or instrument to take a short position in respect of the Company’s securities. The Securities Trading Policy permits share pledges in limited cases with the pre-approval of the Company’s chief compliance officer.

The Company’s executive officers of the Companies do not receive direct compensation from the applicable Company. The compensation of the principals and other investment professionals of Oaktreethe Adviser are paid by Oaktree Administrator.or one of its affiliates. Further, eachthe Company is prohibited under the 1940 Act from issuing equity incentive compensation, including stock options, stock appreciation rights, restricted stock and stock, to its officers or directors, or any employees it may have in the future. Compensation paid to eachthe Company’s chief financial officer and chief compliance officer and their respective staffs and othernon-investment professionals at Oaktree that perform duties for eachthe Company is set by Oaktree Administrator and is subject to reimbursement by eachthe Company of an allocable portion of such compensation for services rendered to it.

During fiscal year 2017, OCSL2021, $1.7 million was incurred by, and $1.2 million was reimbursed FSC CT LLC, its former administrator (the “Former Administrator”), approximately $2.2 millionto, the Oaktree Administrator by the Company for the allocable portion of compensation expenses incurred by the FormerOaktree Administrator on behalf of OCSL’sthe chief financial officer, chief compliance officer and other support personnel of the Company pursuant to its prior administration agreement.

During fiscal year 2017, OCSI reimbursed the Former Administrator approximately $0.7 million for the allocable portion of compensation expenses incurred by the Former Administrator on behalf of OCSI’s chief financial officer, chief compliance officer and other support personnel, pursuant to its prior administration agreement.Administration Agreement.

The following table sets forth compensation of eachthe Company’s directors for the fiscal year ended September 30, 2017:2021:

| Fees Earned or Paid in Cash(1)(2) | Total | |||||||||||||||

Name (Company or Companies) | OCSL | OCSI | OCSL | OCSI | ||||||||||||

Interested Directors: | ||||||||||||||||

Bernard D. Berman (OCSL; OCSI) (3) (4) | — | — | — | — | ||||||||||||

Patrick J. Dalton (OCSL; OCSI) (5) | — | — | — | — | ||||||||||||

Ivelin M. Dimitrov (OCSL; OCSI) (6) | — | — | — | — | ||||||||||||

Alexander C. Frank (OCSL; OCSI) (3) (4) (7) | — | — | — | — | ||||||||||||

John B. Frank (OCSL; OCSI) (8) | — | — | — | — | ||||||||||||

Sandeep K. Khorana (OCSL) (9) | — | — | — | — | ||||||||||||

Todd G. Owens (OCSL; OCSI) (10) | — | — | — | — | ||||||||||||

Independent Directors: | ||||||||||||||||

James Castro-Blanco (OCSL; OCSI) (3) (4) (11) | $ | 167,984 | $ | 98,630 | $ | 167,984 | $ | 98,630 | ||||||||

Richard W. Cohen (OCSI) | — | $ | 97,530 | — | $ | 97,530 | ||||||||||

Brian S. Dunn (OCSL) (3) | $ | 188,061 | — | $ | 188,061 | — | ||||||||||

Richard P. Dutkiewicz (OCSL; OCSI) (4) | $ | 194,880 | $ | 157,783 | $ | 194,880 | $ | 157,783 | ||||||||

Marc H. Gamsin (OCSL; OCSI) (8) | — | — | — | — | ||||||||||||

Byron J. Haney (OCSL) (3) | $ | 157,884 | — | $ | 157,884 | — | ||||||||||

Craig Jacobson (OCSL; OCSI) (8) | — | — | — | — | ||||||||||||

Jeffrey R. Kay (OCSI) (4) | — | $ | 119,840 | — | $ | 119,840 | ||||||||||

Douglas F. Ray (OCSL; OCSI) (3) | $ | 162,903 | $ | 64,289 | $ | 162,903 | $ | 64,289 | ||||||||

Richard G. Ruben (OCSL;OCSI) (8) | — | — | — | — | ||||||||||||

Bruce Zimmerman (OCSL; OCSI) (8) | — | — | — | — | ||||||||||||

| Fees Earned or Paid in Cash(1)(2) | Total Compensation from the Company | Total Compensation from the Fund Complex(3) | ||||||||||

Name | ||||||||||||

Interested Directors: | ||||||||||||

John B. Frank | — | — | — | |||||||||

Independent Directors: | ||||||||||||

Deborah Gero | $ | 163,403 | $ | 163,403 | $ | 213,403 | ||||||

Craig Jacobson | $ | 143,042 | $ | 143,042 | $ | 143,042 | ||||||

Richard G. Ruben(4) | $ | 143,042 | $ | 143,042 | $ | 143,042 | ||||||

Bruce Zimmerman | $ | 158,041 | $ | 158,041 | $ | 158,041 | ||||||

22

| (1) | For a discussion of |

| (2) | The Company |

| (3) | “Fund Complex” includes the Company and OSI II, each |

| (4) | Mr. Ruben resigned as a |

OCSL

For fiscal year 2017,Effective March 19, 2021, the independent directors of OCSL each receivedreceive an annual retainer fee of $100,000, payable once per year to independent directors that attend at least 75% of the meetings held the previous fiscal year.$150,000. In addition, the lead independent directorsdirector and the Chair of OCSL received $2,500 for each Board meeting in which the director attended in personAudit Committee receive an additional $15,000 and $1,000 for each Board meeting in which the director participated other than in person, and reimbursement of reasonableout-of-pocket expenses incurred in connection with attending each Board meeting. The independent directors also received $1,000 for each Board committee meeting in which they attended in person and $500 for each Board committee meeting in which they participated other than in person, and reimbursement of reasonableout-of-pocket expenses incurred in connection with attending a committee meeting not held concurrently with a Board meeting. For fiscal$25,000 per year, 2017,respectively. Prior to March 19, 2021 the independent directors serving on the OCSLCo-Investment Committee, which was responsible for reviewing and approving certainco-investment transactions under the conditions of an exemptive order received from the SEC, also received $500 for eachCo-Investment Committee meeting in which they attended in person and $300 for eachCo-Investment Committee meeting in which they participated other than in person plus reimbursement of reasonableout-of-pocket expenses incurred in connection with attending eachCo-Investment Committee meeting not held concurrently with a Board meeting.

In addition, for fiscal year 2017, the Chairman of the OCSL Audit Committee received an annual retainer of $25,000, the Chairman of the subcommittee of the OCSL Audit Committee received an annual retainer of $25,000, the Chairman of the OCSL Nominating and Corporate Governance Committee and the OCSL Compensation Committee each received an annual retainer of $5,000 and the Chairman of the OCSLCo-Investment Committee received an annual retainer of $15,000.No compensation was paid to directors who were interested persons of OCSL as defined in the 1940 Act.

For fiscal year 2018, the independent directors of OCSL will receive an annual retainer fee of $135,000. In addition, the lead independent director will receive $15,000, and the Chair of the Company’s Audit Committee will also receive $15,000. each received an additional $15,000 per year.

The OCSL Board has also adopted a policy which, over a period of time, requires each independent director to hold Company stock equal to one year’s worth of compensation.

OCSI

For fiscal year 2017, the independent directors of OCSI each received an annual retainer fee of $55,500, payable once per year to independent directors that attend at least 75% of the meetings heldcompensation paid to such director in the previousprior fiscal year. In addition, the independent directors of OCSI received $2,000 for each Board meeting in which the director attended in person and $1,000 for each Board meeting in which the director participated other than in person, and reimbursement of reasonableout-of-pocket expenses incurred in connection with attending each Board meeting. The independent directors also received $1,000 for each Board committee meeting in which they attended in person and $500 for each Board committee meeting in which they participated other than in person, and reimbursement of reasonableout-of-pocket expenses incurred in connection with attending a committee meeting not held concurrently with a Board meeting. For fiscal year 2017, the independent directors serving on the OCSICo-Investment Committee, which was responsible for reviewing and approving certainco-investment transactions under the conditions of the exemptive order received from the SEC, also received $500 for eachCo-Investment Committee meeting in which they attended in person and $300 for eachCo-Investment Committee meeting in which they participated other than in person plus reimbursement of reasonableout-of-pocket expenses incurred in connection with attending eachCo-Investment Committee meeting not held concurrently with a Board meeting.

In addition, for fiscal year 2017, the Chairman of the OCSI Audit Committee received an annual retainer of $25,000, the Chairman of the OCSI Nominating and Corporate Governance Committee and the OCSI Compensation Committee each received an annual retainer of $2,500 and the Chairman of the OCSICo-Investment Committee received an annual retainer of $15,000.No compensation was paid to directors who were interested persons of OCSIthe Company as defined in the 1940 Act.

For fiscal year 2018, theThe independent directors of OCSI will receive an annual retainer fee of $100,000. In addition, the lead independent director will receive $10,000,review and the Chair of the Company’s Audit Committee will also receive $10,000. The OCSI Board has also adopted a policy which, over a period of time, requires each independent director to hold Company stock equal to one year’s worth ofdetermine their compensation.

PROPOSAL 2 — RATIFY THE APPOINTMENT OF ERNST & YOUNG LLP AS THE INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM FOR THE 20182022 FISCAL YEAR

Upon the recommendation of each respectivethe Audit Committee of the Boards, eachBoard, the Board has retained EY as suchthe Company’s independent registered public accounting firm for the fiscal year ending September 30, 2018,2022, subject to ratification by eachthe Company’s stockholders.

On January 4, 2018, PricewaterhouseCoopers LLP (“PwC”) resigned as the independent registered public accounting firm of each Company, and the Audit Committee of each Board accepted the resignation of PwC effective as of that date. PwC served as each Company’s independent registered public accounting firm for the fiscal years ended September 30, 2017 and 2016. The audit reports of PwC on each Company’s consolidated financial statements as of and for the fiscal years ended September 30, 2017 and 2016 did not contain an adverse opinion or a disclaimer of opinion, and they were not qualified or modified as to uncertainty, audit scope or accounting principles.

During the fiscal years ended September 30, 2017 and 2016 and through January 4, 2018, there were no disagreements between either Company and PwC on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures which, if not resolved to the satisfaction of PwC, would have caused PwC to make reference to the subject matter of the disagreements in connection with its audit report, and, except as set forth in the following sentence, there were no “reportable events” as that term is defined in Item 304(a)(1)(v) of RegulationS-K for either Company. As previously disclosed in the Companies’ respective Annual Reports on Form10-K for the fiscal years ended September 30, 2017 and 2016, management and PwC concluded that each Company had a material weakness in internal control over financial reporting because it did not design or maintain effective controls to internally communicate current accounting policies and procedures, including the nature of supporting documentation required to validate certain portfolio company data, as of each of September 30, 2017 and September 30, 2016. Each Audit Committee discussed the material weakness with PwC, and each Company has authorized PwC to respond fully to inquiries of such Company’s successor independent registered public accounting firm concerning this matter. Each Company received a letter from PwC addressed to the Securities and Exchange Commission stating that PwC agrees with the above statements concerning PwC. A copy of PwC’s letters, each dated January 8, 2018, was attached as an exhibit to Form8-Ks filed by each of OCSL and OCSI on January 8, 2018.

Effective January 4, 2018, each Audit Committee engaged EY to serve as such Company’s independent registered public accounting firm. During the fiscal years ended September 30, 2017 and 2016 and through January 4, 2018, none of OCSI, OCSL nor anyone on their behalf consulted with EY regarding: (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s financial statements; or (ii) any matter that was either the subject of a “disagreement” (as defined in Item 304(a)(1)(iv) of RegulationS-K) or a “reportable event” (as defined in Item 304(a)(1)(v) of RegulationS-K).It is expected that a representative of EY will participate in the virtual Annual Meeting and will have an opportunity to make a statement if he or she chooses and will be available to answer questions. It is not expected that a representative of PwC will participate in the virtual Annual Meeting.

The following table presents fees for professional services rendered by PwCEY for the fiscal years ended September 30, 20172021 and 2016.2020.

| 2017 | 2016 | |||||||||||||||||||||||

| OCSL | OCSI | OCSL | OCSI | 2021 | 2020 | |||||||||||||||||||

Audit Fees | $ | 2,538,407 | $ | 544,163 | $ | 1,831,710 | $ | 493,601 | $ | 1,362,000 | $ | 1,177,350 | ||||||||||||

Audit-Related Fees | $ | 30,000 | $ | 10,000 | $ | — | $ | — | $ | — | $ | — | ||||||||||||

AggregateNon-Audit Fees: | ||||||||||||||||||||||||

Tax Fees | $ | 112,000 | $ | 24,900 | $ | 112,900 | $ | 25,000 | $ | 221,000 | $ | 165,000 | ||||||||||||

All Other Fees | — | — | — | — | — | — | ||||||||||||||||||

Total AggregateNon-Audit Fees | $ | 112,000 | (1) | $ | 24,900 | (2) | $ | 112,900 | (3) | $ | 25,000 | (4) | $ | 221,000 | (1) | $ | 165,000 | (2) | ||||||

Total Fees | $ | 2,680,407 | $ | 579,063 | $ | 1,944,610 | $ | 518,601 | $ | 1,583,000 | $ | 1,342,350 | ||||||||||||

| (1) | Non-audit fees |

| (2) | Non-audit fees |

Audit Fees. Audit fees consist of fees billed for professional services rendered for the audit of each the Company’syear-end financial financial statements and services that are normally provided by the independent registered public accounting firm in connection with statutory and regulatory filings.

Audit-Related Fees. Audit-related services consist of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of eachthe Company’s financial statements and are not reported under “Audit Fees.“Audit Fees.” These services include attest services that are not required by statute or regulation and consultations concerning financial accounting and reporting standards.

23

Tax Fees. Tax fees consist of fees billed for professional services for tax compliance. These services include assistance regarding federal, state and local tax compliance.

All Other Fees. All other fees would include fees for products and services other than the services reported above.

Aggregate Non-Audit Fees. Aggregate non-audit fees billed by EY to Oaktree and its affiliates who provide on-going services to the Company during the fiscal year ended September 30, 2021 was $7,216,803. The Audit Committee does not consider the provision of such services to be incompatible with maintaining EY’s independence.

For each Company, theThe affirmative vote of a majority of the votes cast at the Annual Meeting in person or by proxy is required to approve this proposal. Abstentions will not be included in determining the number of votes cast and, as a result, will have no effect on this proposal. Because brokers will have discretionary authority to vote for the ratification of the selection of eachthe Company’s registered independent public accounting firm in the event that they do not receive voting instructions from the beneficial owner of shares of ourthe Company’s common stock, there should not be any brokernon-votes with respect to this proposal.

EachThe Board unanimously recommends a vote “FOR” the proposal to ratify the appointment of Ernst & Young LLP as the independent registered public accounting firm for the applicable Company for the fiscal year ending September 30, 2018.2022.

24

The following is the joint report of the Audit CommitteesCommittee with respect to eachthe Company’s audited financial statements for the fiscal year ended September 30, 2017.2021.

As part of its oversight of eachthe Company’s financial statements, each Company’sthe Audit Committee reviewed and discussed with both management and its independent registered public accounting firm the applicable Company’s audited financial statements filed with the SEC as of and for the fiscal year ended September 30, 2017. Each2021. The Company’s management advised eachthe Audit Committee that all financial statements were prepared in accordance with U.S. generally accepted accounting principles (GAAP), and reviewed significant accounting issues with the Audit Committee. Each Company’sThe Audit Committee discussed with its independent registered public accounting firm the matters required to be discussed by Auditing Standards No. 16,1301 (Communication with Audit Committees). The independent registered public accounting firm also provided to the Audit Committees of both CompaniesCommittee the written disclosures and letter required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accounting firm’s communications with the applicable Company’s Audit Committee concerning independence, and suchthe Audit Committee discussed the subject of independence with the independent registered public accounting firm.

Each Company’sThe Audit Committee has established apre-approval policy that describes the permitted audit, audit-related, tax and other services to be provided by its independent registered public accounting firm. Pursuant to the policies, each Company’sthe Audit Committeepre-approves the audit andnon-audit services performed by the independent registered public accounting firm in order to assure that the provision of such services does not impair the firm’s independence.

Any requests for audit, audit-related, tax, and other services that have not received generalpre-approval must be submitted to the applicable Company’s Audit Committee for specificpre-approval, irrespective of the amount, and cannot commence until such approval has been granted. Normally,pre-approval is provided at regularly scheduled meetings of the applicable Audit Committee. However, suchthe Audit Committee may delegatepre-approval authority to subcommittees of one or more of its members. The member or members to whom such authority is delegated shall report anypre-approval decisions to the applicable Audit Committee at its next scheduled meeting. Neither of the Companies’The Audit Committees delegatesCommittee does not delegate its responsibilities topre-approve services performed by the independent registered public accounting firm to management.

Each Company’sThe Audit Committee has reviewed the audit fees paid by suchthe Company to its independent registered public accounting firm. It has also reviewednon-audit services and fees to assure compliance with the applicable Company’s and Audit Committee’s policies restricting the independent registered public accounting firm from performing services that might impair its independence.

Based on the reviews and discussions referred to above, the Audit Committee of each Company recommended to the applicable Board that the financial statements as of and for the year ended September 30, 2017,2021 be included in eachthe Company’s Annual Report on Form10-K for the year ended September 30, 2017,2021 for filing with the SEC. Each of theThe Audit CommitteesCommittee also recommended the selection of EY to serve as the independent registered public accounting firm of the applicable Company for the fiscal year ending September 30, 2018.2022.

December 22, 2021

The Audit Committee

Deborah Gero, Chair

Bruce Zimmerman, Member

Craig Jacobson, Member

25 |

| |

|

| |

|

| |

|

| |

|

Any stockholder proposals submitted pursuant to Rule 14a-8 under the SEC’s Rule14a-8 Exchange Act for inclusion in eitherthe Company’s proxy statement and form of proxy for the 20192023 annual meeting of stockholders must be received by the applicable Company on or before October 15, 2018.September 22, 2022. Such proposals must also comply with the requirements as to form and substance established by the SEC if such proposals are to be included in the proxy statement and form of proxy. Any such proposal should be mailed to: Oaktree Specialty Lending Corporation, or Oaktree Strategic Income Corporation, as applicable, 333 South Grand Avenue, 28th Floor, Los Angeles, CA 90071, Attention: Secretary. In order for any proposal by an OCSL or OCSI stockholder made outside of Rule14a-8 under the Exchange Act to be considered “timely” within the meaning of Rule14a-4(c) of the Exchange Act, it must be received by the applicable Company not later than December 29, 2018. If your proposal is not “timely” within the meaning of Rule14a-4(c), then proxiesProxies solicited by the applicable Company for the 2019 annual meeting of stockholders maywill confer discretionary voting authority with respect to such Companythese proposals, subject to vote on that proposal.SEC rules governing the exercise of this authority.

Stockholder proposals or director nominations for either Company to be presented at the 2019an annual meeting of stockholders, other than stockholder proposals submitted pursuant to Rule 14a-8 underthe SEC’s Rule14a-8,Exchange Act, must be delivered to, or mailed and received at, the principal executive offices of the applicable Company not more than 150 days and not less than 120 days prior to the date of the anniversary of the previous year’s annual meeting of stockholders. For the 20192023 annual meeting of the Company’s stockholders, of either Company, suchthe Company must receive such proposals and nominations no earlier than November 7, 2018October 5, 2022 and no later than December 7, 2018.November 4, 2022. If the annual meeting of stockholders is scheduled to be held on a date more than thirty30 days prior to or after such anniversary date, stockholder proposals or director nominations must be received no later than the 10th day following the day on which such notice of the date of the 20192023 annual meeting of stockholders was mailed or such public disclosure of the date of the annual meeting was made. Proposals and nominations must also comply with the other requirements contained in OCSL’s or OCSI’sthe Company’s bylaws, as applicable, including supporting documentation and other information and representations.

Each Company’sThe Board does not presently intend to bring any other business before the Annual Meeting. As to any other business that may properly come before the Annual Meeting, however, proxies will be voted in respect thereof in accordance with the discretion of the proxyholders.

Whether or not you expect to participate in the virtual Annual Meeting, please follow the instructions on the Notice of Internet Availability of Proxy Materials to vote via the Internet or telephone, or request, sign, date and return a proxy card so that you may be represented at the Annual Meeting. The Annual Meeting will be a completely virtual meeting of stockholders and will be conducted exclusively by webcast. To participate in the Annual Meeting, visit www.virtualshareholdermeeting.com/ocsl2018 if you are an OCSL stockholder and/or www.virtualshareholdermeeting.com/ocsi2018 if you are an OCSI stockholderocsl2022 and in each case, enter the16-digit control number included in your Notice of Internet Availability of Proxy Materials, on the proxy card you received, or in the instructions that accompanied your proxy materials. Onlinecheck-in will begin at 9:5510:25 a.m., Pacific Time. Please allow time for onlinecheck-in procedures. For questions regarding the virtual Annual Meeting and voting, please contact usthe Company by calling us collect at (212) 284-1900,(213) 830-6300, bye-mail to OCSL atocsl-ir@oaktreecapital.com, or to OCSI atocsi-ir@oaktreecapital.com, or by writing to Oaktree Specialty Lending Corporation, or Oaktree Strategic Income Corporation, as applicable, 333 South Grand Avenue, 28th Floor, Los Angeles, CA 90071, Attention: Secretary.

Please note that only one copy of the 2018 jointthis proxy statement, the applicable 2017Company’s Annual Report on Form 10-K for the year ended September 30, 2021 or Notice of Annual Meeting may be delivered to two or more stockholders of record of OCSL and/or OCSIthe Company who share an address unless we have received contrary instructions from one or more of such stockholders. We will deliver promptly, upon request, a separate copy of any of these documents to stockholders of record of OCSL and/or OCSI at a shared address to which a single copy of such document(s) was delivered. Stockholders who wish to receive a separate copy of any of these documents, or to receive a single copy of such documents if multiple copies were delivered, now or in the future, should submit their request by calling us collect at (212) 284-1900(213) 830-6300 or by writing to Oaktree Specialty Lending Corporation, or Oaktree Strategic Income Corporation, as applicable, 333 South Grand Avenue, 28th Floor, Los Angeles, CA 90071, Attention: Secretary.

26

We fileThe Company files periodic reports, current reports, proxy statements and other information with the SEC. This information is available at the SEC’s public reference room at 100 F Street, NE, Washington, D.C. 20549 and on the SEC’s website at www.sec.gov. The public may obtain information on the operation of the SEC’s public reference room by calling the SEC at (202)551-8090. This information, including eachthe Company’s most recent Annual Report on Form10-K, is also available free of charge by calling us collect at (212) 284-1900,(213) 830-6300, bye-mail to OCSL atocsl-ir@oaktreecapital.com, or to OCSI atocsi-ir@oaktreecapital.com, or by writing to Oaktree Specialty Lending Corporation, or Oaktree Strategic Income Corporation, as applicable, 333 South Grand Avenue, 28th Floor, Los Angeles, CA 90071, Attention: Secretary, or on our website at https://www.oaktreespecialtylending.com or https://www.oaktreestrategicincome.com, respectively.www.oaktreespecialtylending.com. The information on these websitesour website is not incorporated by reference into this proxy statement.

*** Exercise Your Right to Vote ***

Important Notice Regarding the Availability of Proxy Materials for the

Stockholder Meeting to Be Held on April 6, 2018.

27

| ||||

| ||||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

|

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

|

| |||

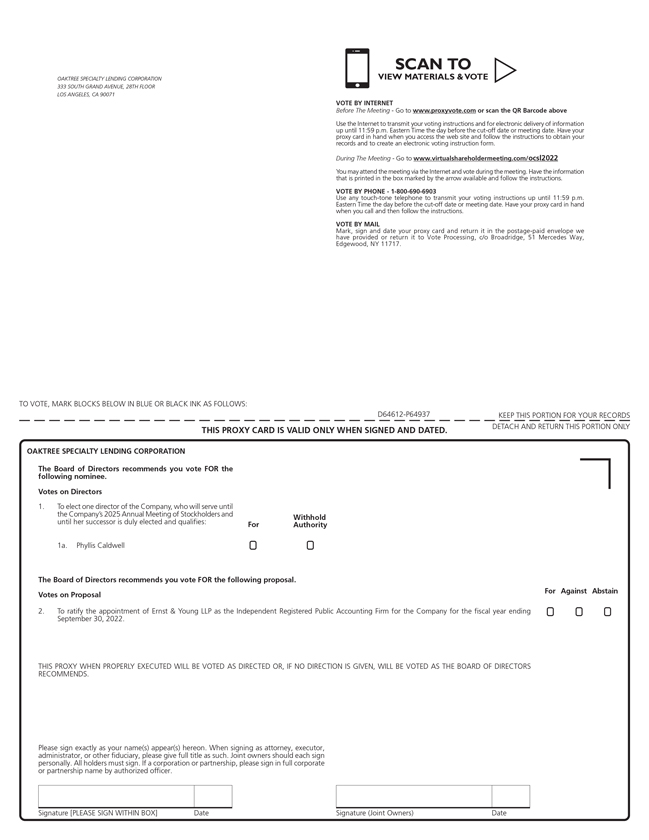

SCAN TO OAKTREE SPECIALTY LENDING CORPORATION VIEW MATERIALS & VOTE w 333 SOUTH GRAND AVENUE, 28TH FLOOR LOS ANGELES, CA 90071 VOTE BY INTERNET Before The Meeting—Go to www.proxyvote.com or scan the QR Barcode above Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. During The Meeting—Go to www.virtualshareholdermeeting.com/ocsl2022 You may attend the meeting via the Internet and vote during the meeting. Have the information that is printed in the box marked by the arrow available and follow the instructions. VOTE BY PHONE—1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions up until 11:59 p.m. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you call and then follow the instructions. VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: D64612-P64937 KEEP THIS PORTION FOR YOUR RECORDS THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. DETACH AND RETURN THIS PORTION ONLY OAKTREE SPECIALTY LENDING CORPORATION The Board of Directors recommends you vote FOR allthe following nominee.Votes on Directors 1. To elect one director of the following nominees.

Company, who will serve until the Company’s 2025 Annual Meeting of Stockholders and Withhold until her successor is duly elected and qualifies: For Authority 1a. Phyllis Caldwell ! ! The Board of Directors recommends you vote FOR the following proposal.

For Against Abstain Votes on Proposal 2. To transact suchratify the appointment of Ernst & Young LLP as the Independent Registered Public Accounting Firm for the Company for the fiscal year ending ! ! ! September 30, 2022. THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED AS DIRECTED OR, IF NO DIRECTION IS GIVEN, WILL BE VOTED AS THE BOARD OF DIRECTORS RECOMMENDS. Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other businessfiduciary, please give full title as may properly come before the Annual Meeting and any adjournmentssuch. Joint owners should each sign personally. All holders must sign. If a corporation or postponements thereof.

|

|

|

|

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

DETACH AND RETURN THIS PORTION ONLY

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED.

|

|

|

| |||||||||||||||||||||

| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

|

|

|

| |||||||||

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting:

The Notice and Proxy Statement and Annual Report are available at www.proxyvote.com.

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

E35717-P01438

D64613-P64937 Oaktree Specialty Lending Corporation ANNUAL MEETING OF STOCKHOLDERS March 4, 2022 10:30 a.m. Pacific Time This proxy is solicited by the

| ||||||||

| ||||||||

*** Exercise Your Right to Vote ***

Important Notice Regarding the Availability of Proxy Materials for the

Stockholder Meeting to Be Held on April 6, 2018.

| ||||

| ||||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

|

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

|

| |||

The Board of Directors recommends youThe undersigned hereby appoints Armen Panossian, Mathew Pendo and Mary Gallegly, and each of them, and each with full power of substitution, to act as attorneys and proxies for the undersigned to vote FOR all the shares of common stock of Oaktree Specialty Lending Corporation (the “Company”) which the undersigned is entitled to vote at the 2022 Annual Meeting of Stockholders of the following nominees.

The Board of Directors recommends you vote FORCompany, to be held virtually on March 4, 2022, at 10:30 a.m. Pacific Time, at the following proposal.

To transact such other business as may properly come before the Annual Meetingwebsite: www.virtualshareholdermeeting.com/ocsl2022, and any adjournments or postponements thereof.

|

|

|

|

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

DETACH AND RETURN THIS PORTION ONLY

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED.

|

|

|

| |||||||||||||||||||||

| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

|

|

|

| |||||||||

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting:

The Notice and Proxy Statement and Annual Report are available at www.proxyvote.com.

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

E35715-P01439

| ||||||||

| ||||||||

(located on the following page).

(located on the following page).